Affordable QuickBooks Integration Plans for Every Business

Tailored financial solutions for your unique business needs

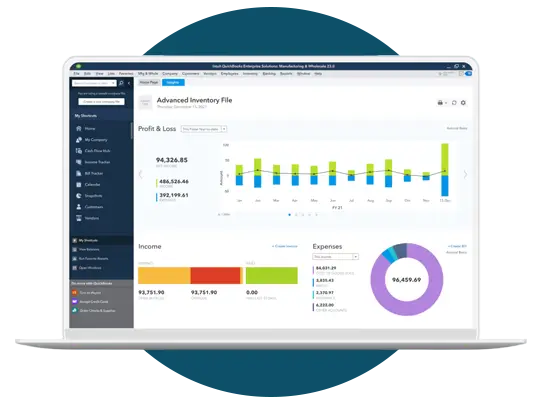

QBIS offers flexible and affordable pricing plans to connect your eCommerce platform with QuickBooks Online and Desktop. Whether you run a Shopify, WooCommerce, Amazon, Magento, or custom store — our automation tools sync your orders, invoices, payments, taxes, and inventory in real time with QuickBooks.

We understand that every business is different. That's why we offer plans that fit startups, growing eCommerce brands, and high-volume enterprises. Our platform eliminates manual entry and errors, saving you time and money.

With over 16 years of experience and more than 70+ active clients, QBIS ensures reliable sync, fast onboarding, and expert support with every plan.

- Real-time automation

- Zero manual work

- QuickBooks Online & Desktop supported

- Free setup assistance

Start your free demo today or request a custom quote based on your business needs.

Why Choose QBIS