Best Tax-Ready Accounting Software for Businesses in 2026: Why Experts Trust QuickBooks

Jan 12, 2026Book a demo with one of our experts!

- Get a guided tour

- Let's do the setup together

- 100% Free

In 2026, tax compliance has become more complex than ever. With changing regulations, digital tax filings, real-time reporting, and tighter deadlines, businesses need more than basic bookkeeping software. They need a tax-ready accounting platform that ensures accuracy, compliance, and automation.

This is why QuickBooks continues to be trusted by accounting experts, CPAs, and growing businesses worldwide. Whether you use QuickBooks Desktop or QuickBooks Online, it remains one of the most reliable solutions for managing taxes efficiently in today’s fast-changing business environment.

What Does “Tax-Ready Accounting Software” Mean in 2026?

A tax-ready accounting system goes beyond recording transactions. In 2026, it should offer:

- Accurate real-time financial data

- Automated tax calculations

- Easy report generation for filing

- Integration with payroll, inventory, and payment systems

- Audit-ready records with proper data mapping

QuickBooks checks all these boxes, making it a preferred choice for businesses of all sizes.

Why Experts Trust QuickBooks for Business Taxes

1. Built-In Tax Automation

QuickBooks automatically tracks income, expenses, and tax categories, reducing manual work and human errors. This automation is critical for businesses handling large transaction volumes.

2. Support for Multiple Tax Types

QuickBooks supports:

- Sales tax

- VAT (region-based)

- Payroll taxes

- Business income tax preparation

This flexibility makes it suitable for diverse industries.

3. Real-Time Financial Reporting

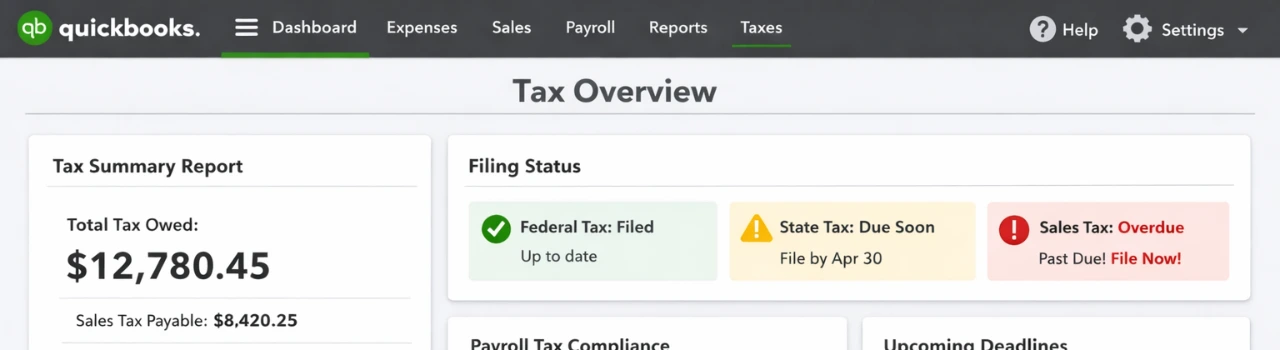

Experts trust QuickBooks because it generates accurate, real-time tax reports, including:

- Profit & Loss

- Balance Sheet

- Tax summary reports

- Expense categorization reports

These reports simplify tax filing and audits.

QuickBooks Desktop vs QuickBooks Online: Tax Readiness Comparison

- Advanced inventory & job costing

- Local data control

- Suitable for complex accounting needs

- Preferred by manufacturing & wholesale businesses

- Cloud-based access

- Automatic updates & backups

- Easy collaboration with accountants

- Ideal for remote teams and service businesses

Both versions are tax-ready, and the right choice depends on your business workflow.

How QuickBooks Helps Businesses Stay Compliant in 2026

Tax compliance is no longer optional—it’s mandatory. QuickBooks helps businesses by:

- Keeping records organized for audits

- Maintaining clean and categorized transactions

- Tracking deductible expenses

- Supporting digital tax filing workflows

This compliance-ready approach is one reason experts continue to recommend QuickBooks.

The Role of Integrations in Tax-Ready Accounting

Modern tax management doesn’t happen in isolation. QuickBooks becomes even more powerful when integrated with:

- Payroll systems

- Inventory management software

- CRM and ERP platforms

- eCommerce and POS systems

With the right QuickBooks integration, businesses achieve end-to-end financial visibility—crucial for accurate tax reporting.

How QBIS Enhances QuickBooks for Tax Readiness

QBIS specializes in QuickBooks integration and data migration, ensuring your accounting system is fully tax-ready.

QBIS Helps With:

- Legacy accounting software → QuickBooks migration

- QuickBooks Desktop ↔ Online transition

- Secure data mapping and validation

- Real-time sync with tax-relevant business systems

- Error-free reporting and compliance setup

With QBIS, businesses don’t just use QuickBooks—they optimize it for tax accuracy and automation.

Who Should Use QuickBooks as a Tax-Ready Solution?

QuickBooks is ideal for:

- Small & mid-sized businesses

- eCommerce sellers

- Service providers

- Manufacturers & wholesalers

- Property management and real estate firms

If taxes impact your cash flow, QuickBooks is built to handle it.

FAQs: Tax-Ready Accounting & QuickBooks

1. Is QuickBooks suitable for business tax filing in 2026?

Yes, QuickBooks supports modern tax workflows and compliance requirements.

2. Can QuickBooks handle sales tax automatically?

Yes, QuickBooks automates sales tax calculations based on rules and regions.

3. Is QuickBooks Desktop still tax-relevant in 2026?

Absolutely. Desktop remains strong for complex accounting and inventory-based businesses.

4. Can I integrate QuickBooks with payroll and tax tools?

Yes, QuickBooks integrates with multiple payroll and tax-related systems.

5. Do I need expert help to make QuickBooks tax-ready?

Professional setup and integration ensure maximum accuracy and compliance.